*The opinions expressed in this article are the author’s own and do not reflect the official views of ICMR.

1. What is Micro-Retirement?

Forget everything you thought you knew about working until you retire. The phrase “you can rest when you retire” just does not cut it anymore. That old model of working non-stop until your 60s then (hopefully) relaxing no longer applies, especially not for the Millennials and Gen Z.

Micro-retirements are not just extended holidays, but rather time-outs to mentally reset, pursue a different passion, further your studies or simply rest and recharge after a period of hectic and intense work life. These breaks can last anywhere between a few months or even few years, depending on the individual. But the point of micro-retirement is that you return to work after these breaks.

The concept gained popularity in the U.S. through Tim Ferriss’s book The 4-Hour Workweek (2007)[1], where he introduced the idea of “mini-retirements” spread out over a lifetime. This idea has gained traction especially among younger workers across cultures who value purpose, balance, and mental well-being over climbing a single career ladder.

2. Navigating Different Types of Career Pauses

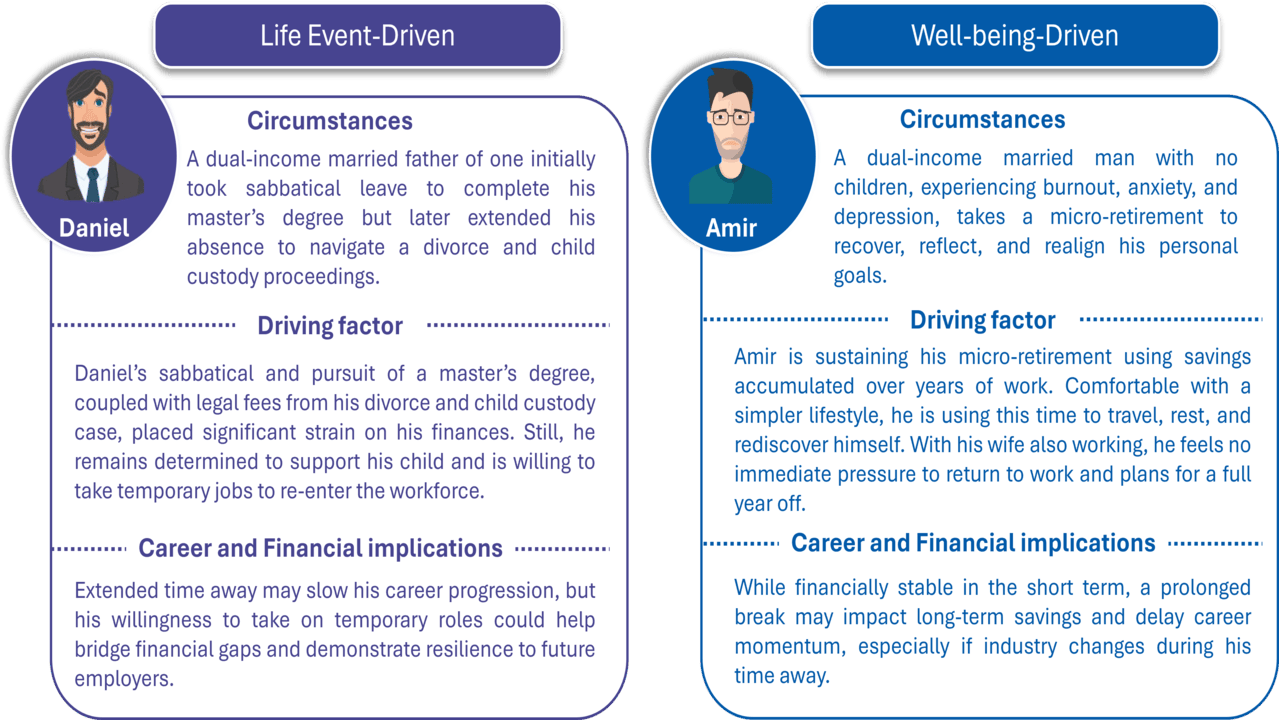

Not all career breaks are the same. The reason why people take breaks vary, and this reason can affect how they manage their time off and the long-term impact on their career and finances. For instance:

- Life-Driven Breaks

Some people take time off to deal with major life events such as the loss of a loved one, caring for family, completing a degree, or healing from a divorce. These breaks often come with clear timelines and a strong motivation to get back on track.

- Mental Health & Burnout Breaks

Others step away because they feel stuck, anxious, or simply exhausted. This group uses the time to breathe, recalibrate, and hopefully return with a clearer sense of purpose. The only downside is that there’s no clear timeline for when one might feel “ready” to return to work.

To illustrate, let’s look at the two personas below:

3. Career Implications

On the upside, micro-retirements can give you room to grow. You might learn a new skill, explore a different industry, or realise what truly matters to you. Taking time off is not always a step back as it can be a pivot towards something more meaningful.

But we also need to be realistic. Taking long breaks does come with risks. Employers may still view career pauses with some hesitation, particularly in more traditional industries. You might miss out on promotions or fall behind peers who remained in the workforce

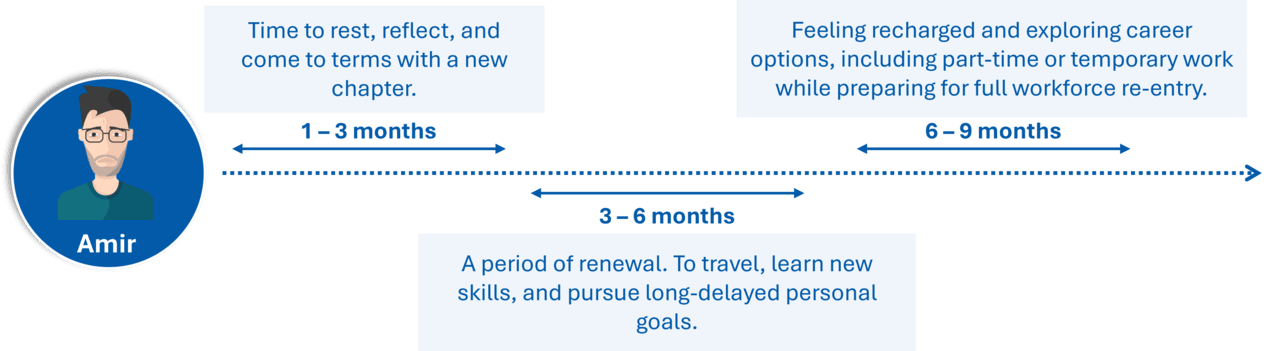

ICMR’s research shows that fear of not having enough becomes a key driver motivating Millennials and Gen Z towards more secure financial planning.[2] Those taking a career break due to life events, like Daniel, often have a clearer timeline and stronger financial motivation to return to the workforce. Meanwhile, Amir’s decision is driven by emotional and mental health needs, leading to a more open-ended timeline and greater uncertainty about future outcomes. The example below illustrates what a typical micro-retirement timeline might look like for someone in Amir’s situation:

In an ideal situation, Amir should be able to get a full-time job after 9 – 12 months of taking a break while pursuing part-time jobs in between. This would ensure that his finances can be recuperated especially since the first 6 months of his break involves cash outflow. Though Amir had a good recovery, he may not be fully aware of the financial implications that micro retirement could have on his long-term finances, if not planned carefully.

4. Financial Implications

So, what does all this mean for your wallet?

Your income stops, but your bills do not. This can have a knock-on effect, particularly on your long-term financial security and retirement savings.

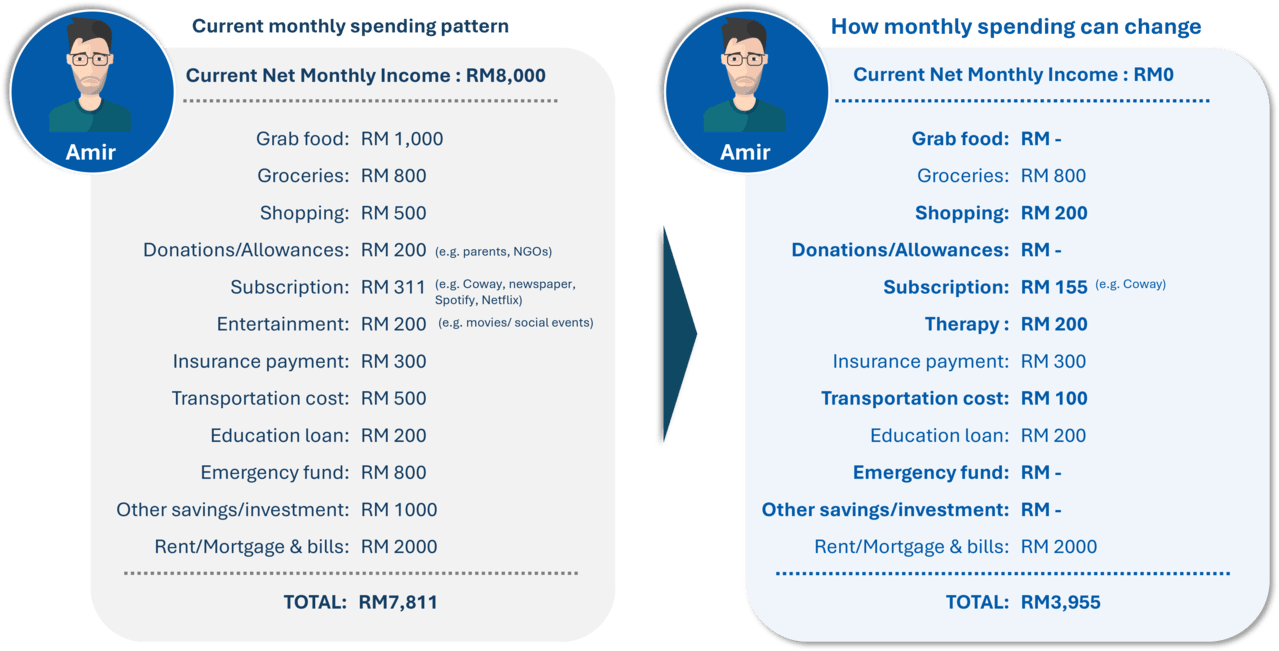

Looking back into Amir’s situation as an example. While he is financially stable for now, taking a break due to burnout comes with many unknowns. If the break extends beyond his initial expectations, he will need to adjust his lifestyle, manage daily expenses carefully, and plan his cash flow accordingly. Without proper planning, this could gradually impact his overall financial resilience and long-term stability.

On a monthly basis, this shows how Amir might need to adjust his spending to cope without a fixed income.

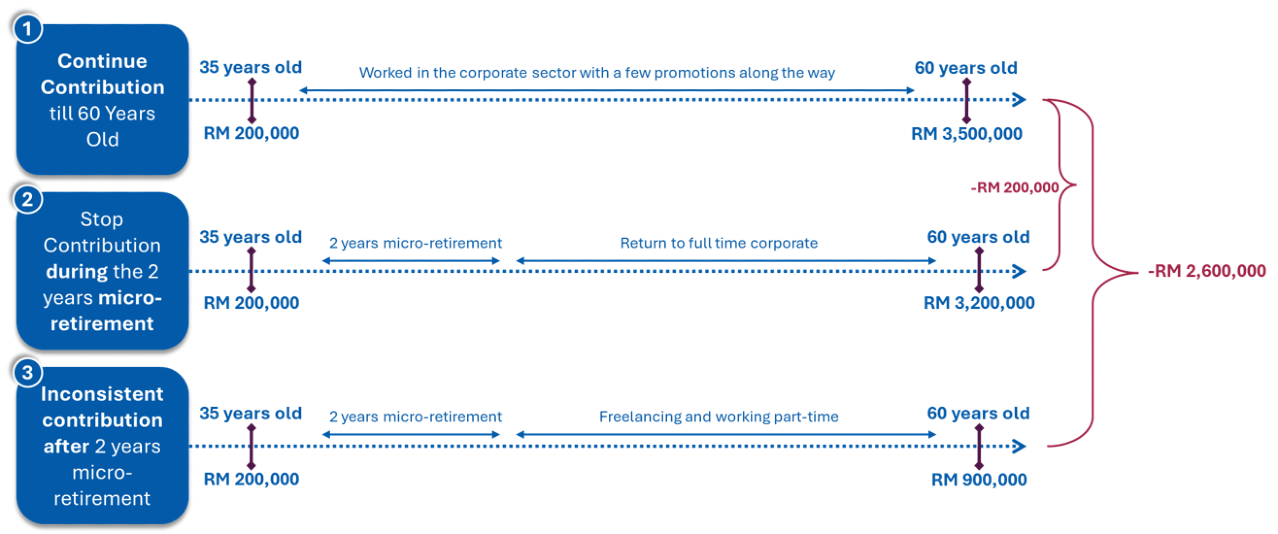

While Amir’s short-term needs may be manageable with lifestyle adjustments, the longer-term financial implications of taking a micro-retirement, particularly ones triggered by burnout, can be more complex. One of the most significant concerns is the potential impact on his retirement savings. Without a stable income, consistent contributions to long-term savings vehicles like the EPF can be disrupted, creating gaps that may be difficult to recover from later.

Malaysia’s EPF system, for instance, is designed with the assumption of regular monthly contributions. While schemes like i-Saraan allow voluntary top-ups (up to RM100,000 per year), the RM500 annual government incentive, capped at RM5,000 for life, may not be enough to ensure long-term financial stability for those who take multiple breaks.

Looking back into Amir’s case, this is what his EPF contribution will look like in three different scenarios:

Disclaimer: The figures presented are illustrative estimates based on Amir’s scenario and may not reflect actual outcomes or financial projections

Overall, micro-retirement can be a meaningful investment in your well-being, clarity, and personal growth. But that investment must be weighed against the financial risks it brings, from short-term income gaps to long-term impacts on retirement savings. Finding the right balance between rest and responsibility is what makes the pause truly worth it.

5. What Needs to Change

The rise of micro-retirement as a lifestyle and financial choice challenges not only individual financial planning models but also the foundational assumptions embedded in traditional retirement policies. Most existing pension and retirement frameworks are built on the assumption of a linear career marked by consistent income and regular contributions. This structure no longer reflects the realities of a growing number of workers, especially younger cohorts navigating non-linear careers, contract-based employment, and extended career breaks.

If micro-retirement is becoming the new normal, then our retirement systems, policies, workplace practices, and social expectations all need to evolve accordingly.

To close these gaps between the traditional and the non-linear careers, there are a number of policy reforms that can be considered:

- Flexible contribution mechanisms

Expand contribution mechanisms to include options for voluntary lump-sum top-ups or automatic catch-up contributions after career breaks. These contributions can be benchmarked towards basic saving, adequate and enhanced savings by age[3].

- Redefining Benefits

Your healthcare, pension, and insurance coverage should follow you, rather than being tied to a specific employer.

- Normalising Career Pauses in Organisations

Employers should view career breaks as a long-term investment in employee well-being, rather than a risk. Organisations could also consider integrating sabbatical leave into their benefits structure.

- Better Tools, Financial Literacy and Awareness

Equip individuals with budgeting tools, financial literacy and planning resources, as well as accessible information to help them plan and navigate career breaks more effectively.

Internationally, some countries and corporations have begun piloting adaptive retirement systems, offering phased retirement, sabbatical-linked benefit credits, or hybrid pension models. These early efforts provide a glimpse of what a more responsive and inclusive retirement framework could look like. Among them include:

- Belgium: a government scheme allows employees to take a career break of up to a year, during which they receive a paid allowance from the government. Previous research into the scheme showed that 76 per cent of employees taking full-time career breaks from both public and private sectors were aged between 25 and 49[4].

- Australia: many employees are entitled to paid long service leave after serving between seven and 10 years with the same employer, depending on which state or territory they are in[5].

- Germany: provides flexible retirement options, allowing individuals aged 50 and above to make special contributions to offset early retirement deductions. The approach also offers financial incentives to encourage continued work beyond retirement age[6].

6. Conclusion

Micro-retirement represents more than just a lifestyle trend; it signals a fundamental shift in how individuals approach work, rest, and long-term planning. For many younger generations, the idea of waiting until 60 to finally “rest” just doesn’t make sense anymore. They would prefer balance, purpose, and the chance to reset when life demands it.

As with most non-linear career paths, the outcome of micro-retirement on career progression depends significantly on context. Factors such as timing, norms, individual performance, and the ability to clearly communicate the value of one’s time away all play a role. But that also means our systems need to catch up. Employers, policymakers, and financial institutions all have a role to play in rethinking retirement plans, job benefits, and how we define a successful career path. With the right support, micro-retirements can actually lead to healthier minds, stronger careers, and smarter long-term planning.

Still, it’s not one-size-fits-all. The impact on your career depends a lot on timing, your industry, and how you explain your time off. If you’re thinking about taking a break but unsure about the risks, this piece is for you.

So, are you considering a micro-retirement?

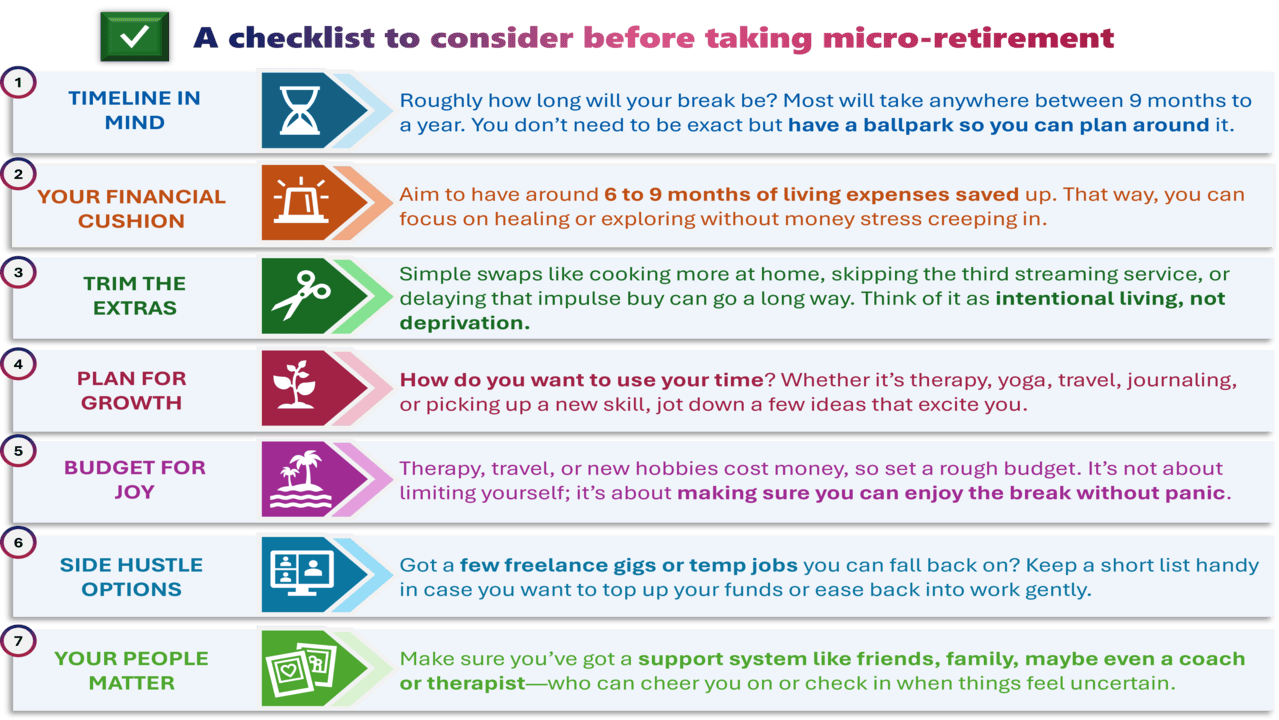

Taking time to plan can make the difference between a well-deserved recharge and an overwhelming experience. Do consider the checklist below to help you think through what you need before taking the leap.

Most importantly, maintain a positive vibe!

At the end of the day, micro-retirement isn’t about slacking off. But it’s about living more intentionally. For younger generations navigating uncertain futures, this might just be the balance we need between hustle and self-care. =)

References

- Ferriss, T. (2007). The 4-Hour Workweek: Escape 9–5, Live Anywhere, and Join the New Rich. Crown Publishing Group.

- ICMR (2021): The Rise of Millennial & Gen Z Investors: Trends, Opportunities, and Challenges for Malaysia

- Employees Provident Fund. (2024, May 2). EPF releases Belanjawanku 2024/2025 and Retirement Income Adequacy Framework. https://www.kwsp.gov.my/en/w/epf-releases-belanjawanku-2024/2025-and-retirement-income-adequacy-framework

- Startup Daily. (2024, April 5). Gen Zs are taking a mid-career micro-retirement to prevent burnout – but there’s still a cost. https://www.startupdaily.net/advice/future-of-work/gen-zs-are-taking-a-mid-career-micro-retirement-to-prevent-burnout-but-theres-still-a-cost/

- Fair Work Ombudsman. (n.d.). Long service leave. Australian Government. https://www.fairwork.gov.au/leave/long-service-leave

- IAB Forum. (n.d.). Flexible Pension Act (Flexirenten Gesetz). https://iab-forum.de/en/glossar/flexible-pension-act-flexirenten-gesetz/