PE/VC: Private Market Participants

ICMR Data Storyboard

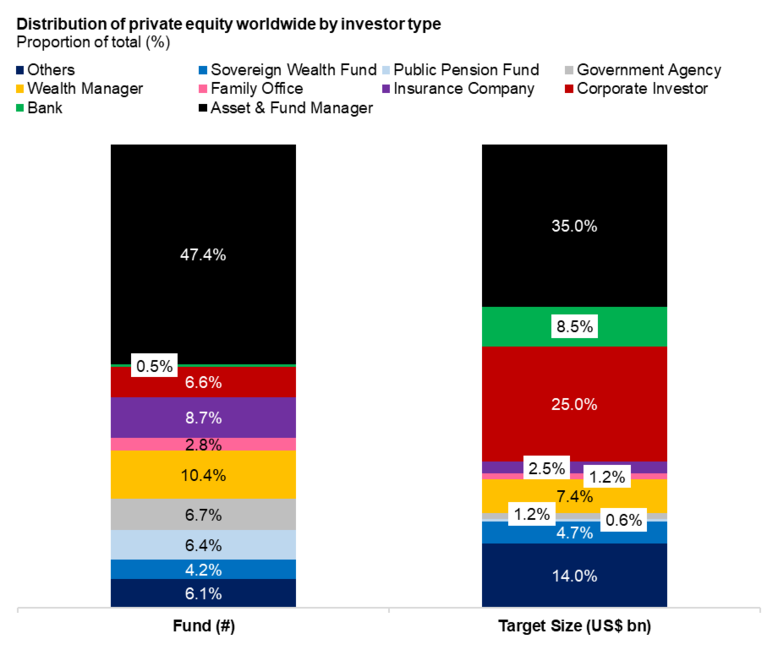

Global Private Equity by Investor Type

Private equity remains as the preferred investment among wealth manager (10.4%) and insurance company (8.7%) globally despite only making up to 7.4% and 2.5% of total funds commitment.

The largest level of capital being sought are from asset & fund managers (14.0%), and corporate investors (25.0%).

Source: Preqin data as of December 2018, ICMR internal calculation.

Note: Data exclude infrastructure core, infrastructure core plus, infrastructure core fund of funds, Mezzanine, Natural Resources, Private Debt fund of Funds, PIPE, and Venture Debt.

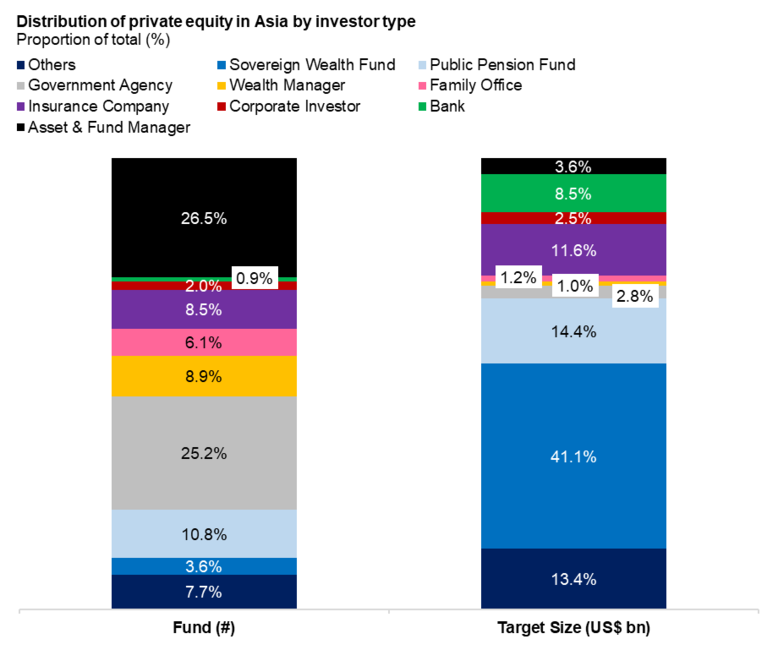

Private Equity in Asia by Investor Type

Asia witnessed a stark variation in public funds compared to private participation in private equity. Government agency, public pension fund and sovereign wealth fund collectively make up almost 40.0% of the fund count.

Fund raising landscape in Asia are still dependent on public funding, marked by the high amount of funds raised from the public sector (58.3%).

Sovereign wealth fund (41.1%) remain as the largest source of contributor to private equity followed by public pension fund (14.4%), and asset & fund manager (13.4%) in terms of funds commitment.

Source: Preqin data as of December 2018, ICMR internal calculation.

Note: Data exclude infrastructure core, infrastructure core plus, infrastructure core fund of funds, Mezzanine, Natural Resources, Private Debt fund of Funds, PIPE, and Venture Debt.